NEW YORK: The chief

executive of Morgan Stanley on Wednesday defended his company's lead

role in the disastrous IPO of Facebook, which has lost investors

billions of dollars.

James Gorman told an internal staff meeting

that the bank had worked "100 per cent within the rules" in heading the

US$16 billion stock issue, according to a person who was at the

meeting.

The source said Gorman also condemned the "speculation

of nefarious activity" that has surrounded the issue and drawn at least

eight class action lawsuits against Facebook and its underwriters.

He

said the social networking giant itself was happy with the bank, even

though the company's shareprice has now sunk nearly 26 per cent from the

US$38 initial public offering price.

Facebook's chief operating

officer Sheryl Sandberg had told him that the company "is very pleased

with the way Morgan Stanley conducted itself, (saying) that we were very

professional," Gorman told the group, according to the source.

Gorman

blamed the overall economic environment -- especially the Greek

financial crisis -- as well as technical problems at the Nasdaq market

for "unprecedented confusion and disarray at the opening," when Facebook

shares began trading on May 18.

"You don't control Nasdaq and you don't control Greece and the environment," he said.

It all "made for a very difficult start" .

Facebook's

shares barely held above the issue price on the first day of trade and

have steadily fallen ever since, wiping US$27 billion off of the

company's IPO market valuation of US$104 billion.

Those losses have been taken by investors who are furious over how the country's second largest IPO ever flopped.

The

anger stems in part from Morgan Stanley's having approved an increase

in the shares issued and the share price just days before the share

sale.

Also driving the fury and the lawsuits are allegations

that the underwriters had given their best institutional clients

private, downbeat forecasts for Facebook's finances just before the

shares hit the market, while denying the same information to small

investors.

The result, the accusations say, was that the

better-informed big investors immediately dumped their shares leaving

smaller investors to take the losses.

Gorman insisted that the shareprice should be seen over a 12 month period, and not just in the short term.

"Facebook is a great company and will still be in so in a few months," he said.

Wednesday, May 30, 2012

3 changes to ease COE crunch by August: LTA

SINGAPORE - The Land Transport Authority (LTA) today announced three

measures it will take to ease the rising prices of certificates of

entitlement (COE).

This comes after Minister for Transport Lui Tuck Yew asked LTA to possibly delay plans of implementing the 0.5 per cent growth cap, from the current 1.5 per cent rate, initially scheduled to begin in August.

In a statement to the media, the LTA said that it will reduce vehicle growth rate to 1 per cent from August instead of 0.5 per cent as previously announced. The percentage will then be further reduced to 0.5 per cent from February 2013 to January 2015.

This move will make available about 390 more

COEs per month from August 2012 to January 2013 which is equivalent to

about 10 per cent of the current monthly quota.

Secondly, the claw-back of over supplied COEs, which totals 4,789, made in 2008 and 2009 will be further deferred to July 2013 - a delay of one year. Adjustments will resume from August 2013 to January 2013.

This change will make available 266 more COEs per month, or about 7 per cent of the current monthly quota.

Thirdly, LTA will reduce COEs in the Open Category (Cat E). Currently 25 per cent of COEs from each of the four other vehicle categories make up the supply in Cat E.

In an attempt to maintain a more stable supply of COEs in each category, this percentage will be reduced to 20 per cent from August 2012 and then to 15 per cent from February 2013.

This will redistribute more COEs from Open to the other categories.

The quota for the COE bidding period from August 2012 to January 2013 will be announced in July 2012.

This comes after Minister for Transport Lui Tuck Yew asked LTA to possibly delay plans of implementing the 0.5 per cent growth cap, from the current 1.5 per cent rate, initially scheduled to begin in August.

In a statement to the media, the LTA said that it will reduce vehicle growth rate to 1 per cent from August instead of 0.5 per cent as previously announced. The percentage will then be further reduced to 0.5 per cent from February 2013 to January 2015.

Secondly, the claw-back of over supplied COEs, which totals 4,789, made in 2008 and 2009 will be further deferred to July 2013 - a delay of one year. Adjustments will resume from August 2013 to January 2013.

This change will make available 266 more COEs per month, or about 7 per cent of the current monthly quota.

Thirdly, LTA will reduce COEs in the Open Category (Cat E). Currently 25 per cent of COEs from each of the four other vehicle categories make up the supply in Cat E.

In an attempt to maintain a more stable supply of COEs in each category, this percentage will be reduced to 20 per cent from August 2012 and then to 15 per cent from February 2013.

This will redistribute more COEs from Open to the other categories.

The quota for the COE bidding period from August 2012 to January 2013 will be announced in July 2012.

CPF minimum sum to be raised to $139,000

The CPF minimum sum will be revised upwards to $139,000 from the

previous $131,000 from July 1 said the Ministry of Manpower (MOM) on

Wednesday.

The new minimum sum will apply to CPF members who turn 55 from July 1, 2012 and June 30, 2013.

The Medisave minimum sum will also be raised to $38,500 from the previous amount of $36,000.

Members will be able to withdraw their Medisave savings in excess of the Medisave minimum sum at or after age 55.

The maximum balance a member can have in the Medisave account is fixed at $5,000 above the Medisave minimum sum.

Corresponding to the increase in the Medisave minimum sum, this ceiling would also be increased to $43,500 from $41,000.

Any Medisave contribution in excess of the prevailing ceiling will be transferred to the Special Account if the member is below 55 years old or his Retirement Account if he is above 55 and has a shortfall in his minimum sum.

The CPF board said that the revisions, which have been adjusted for inflation, are to ensure that Singaporeans have sufficient savings to meet their healthcare expenses.

The new minimum sum will apply to CPF members who turn 55 from July 1, 2012 and June 30, 2013.

The Medisave minimum sum will also be raised to $38,500 from the previous amount of $36,000.

The maximum balance a member can have in the Medisave account is fixed at $5,000 above the Medisave minimum sum.

Corresponding to the increase in the Medisave minimum sum, this ceiling would also be increased to $43,500 from $41,000.

Any Medisave contribution in excess of the prevailing ceiling will be transferred to the Special Account if the member is below 55 years old or his Retirement Account if he is above 55 and has a shortfall in his minimum sum.

The CPF board said that the revisions, which have been adjusted for inflation, are to ensure that Singaporeans have sufficient savings to meet their healthcare expenses.

Monday, May 28, 2012

S'pore expats have second highest incomes globally

SINGAPORE - Expatriates in Singapore rank second in the world for

income, with half earning over US$200,000 ($254,973) a year, a recent

survey found.

The 2011 Expat Explorer Survey by HSBC also revealed that expat wealth remained widely immune to global economic troubles.

Expats in Singapore ranked top in Asia and third in the world for expat wealth and finances in areas such as earning levels, disposable income, spending, saving, investing patterns and the impact of the current global financial climate.

As such, it is no surprise that the survey results concluded that Singapore is regarded as the ideal expat destination - able to offer the best balance of career prospects, economic returns, quality of life and raising of children.

However, the survey also found that expats in Singapore faced higher cost of living such as accommodation, food and bringing up of children.

The survey sought the opinions of nearly 3,400 expats from over 100 countries across the globe on their experiences working and living overseas.

This year, for its 5th annual survey, HSBC is calling for expats to take part in its latest survey.

This year's survey will be focusing on emerging issues on how expats have fared after the global economic turmoil and social unrest faced in some countries, as well as tips and tricks on how to best live in a foreign country.

The 2011 Expat Explorer Survey by HSBC also revealed that expat wealth remained widely immune to global economic troubles.

Expats in Singapore ranked top in Asia and third in the world for expat wealth and finances in areas such as earning levels, disposable income, spending, saving, investing patterns and the impact of the current global financial climate.

As such, it is no surprise that the survey results concluded that Singapore is regarded as the ideal expat destination - able to offer the best balance of career prospects, economic returns, quality of life and raising of children.

However, the survey also found that expats in Singapore faced higher cost of living such as accommodation, food and bringing up of children.

The survey sought the opinions of nearly 3,400 expats from over 100 countries across the globe on their experiences working and living overseas.

This year, for its 5th annual survey, HSBC is calling for expats to take part in its latest survey.

This year's survey will be focusing on emerging issues on how expats have fared after the global economic turmoil and social unrest faced in some countries, as well as tips and tricks on how to best live in a foreign country.

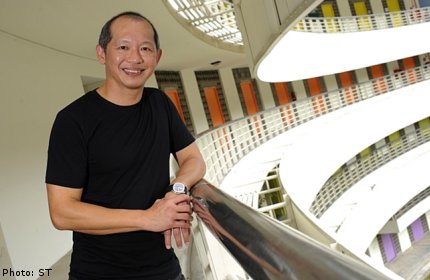

National Arts Council CEO Benson Puah diagnosed with cancer

SINGAPORE - The Chief Executive Officer for the National Arts Council and the Esplanade has been diagnosed with lymphoma.

The illness is a type of cancer that begins in the immune system cells.

The 54-year-old, dubbed as the most powerful man in the Singapore art scene, was diagnosed with the condition last Thursday.

A joint statement released by both organisations on Monday said that Mr Puah begins a 16-week-long treatment today.

He will continue with his duties at the Esplanade and NAC as normally as his condition will allow him to and operations at both organisation will function as usual.

What causes lymphoma?

Non-Hodgkin's lymphoma (also called NHL) is cancer that begins in the lymphatic system. The lymphatic system is part of the body's immune system. The immune system fights infection and other diseases.

A person with certain risk factors may be more likely than others to develop lymphoma. Studies reveal that individuals who have a weak immune system (such as autoimmune disorder), or suffering from certain types of infections (such as Human immunodeficiency virus, HIV) are at higher risk of developing non-Hodgkin's lymphoma.

Although non-Hodgkin's lymphoma can occur in young people, the chances of developing this disease go up with age. Most people with non-Hodgkin's lymphoma are older than 60 years of age.

Symptoms

- Swollen, painless lymph nodes in the neck, armpits, or groin

- Unexplained weight loss

- Fever

- Soaking night sweats

- Coughing, trouble breathing, or chest pain

- Weakness and tiredness that don’t go away

- Pain, swelling, or a feeling of fullness in the abdomen

Types of treatment available

Chemotherapy, Biological Therapy, Radiation Therapy and Stem Cell Transplantation.

Information provided by Parkway Cancer Centre. To find out more, click here

The illness is a type of cancer that begins in the immune system cells.

The 54-year-old, dubbed as the most powerful man in the Singapore art scene, was diagnosed with the condition last Thursday.

A joint statement released by both organisations on Monday said that Mr Puah begins a 16-week-long treatment today.

He will continue with his duties at the Esplanade and NAC as normally as his condition will allow him to and operations at both organisation will function as usual.

What causes lymphoma?

Non-Hodgkin's lymphoma (also called NHL) is cancer that begins in the lymphatic system. The lymphatic system is part of the body's immune system. The immune system fights infection and other diseases.

A person with certain risk factors may be more likely than others to develop lymphoma. Studies reveal that individuals who have a weak immune system (such as autoimmune disorder), or suffering from certain types of infections (such as Human immunodeficiency virus, HIV) are at higher risk of developing non-Hodgkin's lymphoma.

Although non-Hodgkin's lymphoma can occur in young people, the chances of developing this disease go up with age. Most people with non-Hodgkin's lymphoma are older than 60 years of age.

Symptoms

- Swollen, painless lymph nodes in the neck, armpits, or groin

- Unexplained weight loss

- Fever

- Soaking night sweats

- Coughing, trouble breathing, or chest pain

- Weakness and tiredness that don’t go away

- Pain, swelling, or a feeling of fullness in the abdomen

Types of treatment available

Chemotherapy, Biological Therapy, Radiation Therapy and Stem Cell Transplantation.

Information provided by Parkway Cancer Centre. To find out more, click here

LTA to change traffic light timings at Ferrari crash junction

SINGAPORE - The Land Transport Authority (LTA) announced on Monday evening that it would synchronise the timings of the traffic lights where two accidents occurred within a span of just two weeks.

A local news source reported that the traffic signals at the junction of Rochor Road and Victoria Street and the pedestrian crossing linking Bugis Junction and Bugis Village will now turn green at about the same time.

LTA said it was just an "added precautionary measure".

While LTA said it was implementing the change based on feedback from the public, it found no issues with the existing traffic scheme at the location.

The call for improvment to the traffic signals at the junction of Rochor Road and Victoria Street came in the wake of two accidents which claimed the lives of three and three others injured.

The first accident on May 12 involved a speeding Ferrari, while the second accident on May 26 involved a Lexus. Both cars crashed into taxis.

Both accidents happened in the wee hours on a Saturday and involved cars travelling in the same direction.

Suggesting one theory on how the accidents might have happened is Dr Lee Der-Horng, associate professor of civil engineering at the National University of Singapore, who said the timing of the traffic signals might have been a factor in the accidents.

"One possibility is at the pedestrian crossing, maybe the driver tried to beat the yellow signal.

"So after he travelled the 50, 60 metres, when he reached the major intersection, the traffic signal already turned to red," he said.

Dr Lee feels that the intersection is actually satisfactory from the safety's point of view.

But added that perhaps, overhead traffic lights would give drivers a better view of the signal.

After careful evaluation of the traffic signal configuration, LTA found that the traffic lights at the junction are distinct and can be clearly seen by the driver, whichever lane they are driving on.

LTA had deployed its traffic engineers to drive through the junction of Victoria Street and Rochor Road during the day and in the middle of the night to film the line of sight from a driver's perspective.

"The traffic planning engineers have conducted a careful evaluation of the traffic signal configuration, and assessed that there are no issues with the existing traffic scheme at that location," LTA said.

The Singapore Road Safety Council also weighed in and said it will consider the need to tighten specific road safety measures, after police investigations into the two accidents are completed.

A local news source reported that the traffic signals at the junction of Rochor Road and Victoria Street and the pedestrian crossing linking Bugis Junction and Bugis Village will now turn green at about the same time.

LTA said it was just an "added precautionary measure".

While LTA said it was implementing the change based on feedback from the public, it found no issues with the existing traffic scheme at the location.

The call for improvment to the traffic signals at the junction of Rochor Road and Victoria Street came in the wake of two accidents which claimed the lives of three and three others injured.

The first accident on May 12 involved a speeding Ferrari, while the second accident on May 26 involved a Lexus. Both cars crashed into taxis.

Both accidents happened in the wee hours on a Saturday and involved cars travelling in the same direction.

Suggesting one theory on how the accidents might have happened is Dr Lee Der-Horng, associate professor of civil engineering at the National University of Singapore, who said the timing of the traffic signals might have been a factor in the accidents.

"One possibility is at the pedestrian crossing, maybe the driver tried to beat the yellow signal.

"So after he travelled the 50, 60 metres, when he reached the major intersection, the traffic signal already turned to red," he said.

Dr Lee feels that the intersection is actually satisfactory from the safety's point of view.

But added that perhaps, overhead traffic lights would give drivers a better view of the signal.

After careful evaluation of the traffic signal configuration, LTA found that the traffic lights at the junction are distinct and can be clearly seen by the driver, whichever lane they are driving on.

LTA had deployed its traffic engineers to drive through the junction of Victoria Street and Rochor Road during the day and in the middle of the night to film the line of sight from a driver's perspective.

"The traffic planning engineers have conducted a careful evaluation of the traffic signal configuration, and assessed that there are no issues with the existing traffic scheme at that location," LTA said.

The Singapore Road Safety Council also weighed in and said it will consider the need to tighten specific road safety measures, after police investigations into the two accidents are completed.

Maid dies after church lift falls on her

SINGAPORE - A Filipino maid died after a church lift fell on her in a

freak accident at the Catholic Church of St Michael off Serangoon Road,

The Straits Times (ST) reported.

Ms Clarita Abanes, 46, was on the ground floor of the four-storey church helping a 70-year-old woman enter the lift when the accident occurred on the evening of May 16.

She was going to the second floor for mass, her friends and relatives said.

According to Ms Abanes' cousin, who gave her name as Ms Logie, it was likely that Ms Abanes did not notice that the lift had not descended to touch the ground floor when she pulled open the glass doors of the lift.

The lift then fell on both Ms Abanes and the elderly woman and trapped them underneath.

Ms Logie said that the glass door can be manually pulled open only when the lift has arrived at the designated floor, and expressed puzzlement as to why the doors were able to be opened in the first place.

Ms Abanes was seriously injured and died last Thursday after being in a coma. The unnamed elderly woman has been hospitalised but is conscious now.

She was given a send-off in the same church on Monday.

Donations are being collected by foreign worker welfare group Humanitarian Organisation for Migration Economics for her family.

Ms Clarita Abanes, 46, was on the ground floor of the four-storey church helping a 70-year-old woman enter the lift when the accident occurred on the evening of May 16.

She was going to the second floor for mass, her friends and relatives said.

According to Ms Abanes' cousin, who gave her name as Ms Logie, it was likely that Ms Abanes did not notice that the lift had not descended to touch the ground floor when she pulled open the glass doors of the lift.

The lift then fell on both Ms Abanes and the elderly woman and trapped them underneath.

Ms Logie said that the glass door can be manually pulled open only when the lift has arrived at the designated floor, and expressed puzzlement as to why the doors were able to be opened in the first place.

Ms Abanes was seriously injured and died last Thursday after being in a coma. The unnamed elderly woman has been hospitalised but is conscious now.

She was given a send-off in the same church on Monday.

Donations are being collected by foreign worker welfare group Humanitarian Organisation for Migration Economics for her family.

Sunday, May 27, 2012

Your bank deposits and insurance policies are protected in Singapore

This scheme is administered by Singapore Deposit Insurance Corporation

(SDIC), a company that is created by the Government of Singapore to look

after small depositors and policy owners’ interests. The other scheme,

Deposit Insurance Scheme, protects your bank deposits.

Not all banks are covered. Does the bank that holds your deposit covered?

What deposits are covered and what are not?

The following Singapore dollar denominated deposits placed with a DI Scheme member are covered:

Up to S$50,000. You can claim another S$50,000 for deposits under CPF Investment and Minimum Sum Scheme.

Where does SDIC get the money to pay you?

SDIC collects premium from the members and invest in liquid assets like Singapore Government Bonds.

POLICY OWNERS’ PROTECTION SCHEME

This scheme protects both life and general insurance.

Is your insurer in this scheme?

Depending on the type of your life insurance, the guarantee ranges from S$50,00 to S$500,000. There is no cap on the Accident and Health policies (less riders). For more details, see https://www.sdic.org.sg/pp_calc_of_comp.php

Where does SDIC get the money to pay you?

Likewise, SDIC collects levies members based on the size of their protected liabilities. SDIC invests in safe and liquid assets like Singapore Government Bonds.

I see this is a good approach to protect the minorities’ interests. This would also boost the confidence in our savings and insurance industry. To be sure, you should do a check on the proportion of your deposits and insurance policies that would qualify under these schemes.

DEPOSIT INSURANCE SCHEME

This scheme started in 2006 and several amendments were made since 2008. It was apt to have this policy in place during the Global Financial Crisis where confidence was obviously shaken with financial institutions collapses (Lehman and Bear Sterns) or on the verge of collapse (AIG and other mortgage companies).Not all banks are covered. Does the bank that holds your deposit covered?

- AUSTRALIA AND NEW ZEALAND BANKING GROUP LIMITED

- BANGKOK BANK PUBLIC COMPANY LIMITED

- BANK OF AMERICA, NATIONAL ASSOCIATION

- BANK OF CHINA LIMITED

- BANK OF EAST ASIA LTD

- BANK OF INDIA

- BANK OF TOKYO-MITSUBISHI UFJ, LTD

- BNP PARIBAS

- CIMB BANK BERHAD

- CITIBANK NA

- CITIBANK SINGAPORE LIMITED

- CREDIT AGRICOLE CORPORATE & INVESTMENT BANK

- DBS BANK LTD

- FAR EASTERN BANK LTD

- HL BANK

- HONG LEONG FINANCE LIMITED

- HONGKONG AND SHANGHAI BANKING CORPORATION LIMITED

- ICICI BANK LIMITED

- INDIAN BANK

- INDIAN OVERSEAS BANK

- JPMORGAN CHASE BANK, NA

- MALAYAN BANKING BHD

- MIZUHO CORPORATE BANK LTD

- OVERSEA-CHINESE BANKING CORPN LTD

- PT BANK NEGARA INDONESIA (PERSERO) TBK

- RHB BANK BERHAD

- SING INVESTMENTS & FINANCE LIMITED

- SINGAPORE ISLAND BANK LIMITED

- SINGAPURA FINANCE LTD

- STANDARD CHARTERED BANK

- STATE BANK OF INDIA

- SUMITOMO MITSUI BANKING CORPORATION

- UCO BANK

- UNITED OVERSEAS BANK LTD

What deposits are covered and what are not?

The following Singapore dollar denominated deposits placed with a DI Scheme member are covered:

- savings account

- fixed deposit account

- current account

- money in CPF Investment Scheme

- money in CPF Minimum Sum Scheme

- money in Supplementary Retirement Scheme

- Murabaha, as prescribed by the Authority

- Foreign currency deposits

- Structured deposits

- Investment products such as unit trusts, shares and other securities

Up to S$50,000. You can claim another S$50,000 for deposits under CPF Investment and Minimum Sum Scheme.

Where does SDIC get the money to pay you?

SDIC collects premium from the members and invest in liquid assets like Singapore Government Bonds.

POLICY OWNERS’ PROTECTION SCHEME

This scheme protects both life and general insurance.

Is your insurer in this scheme?

- ACE INSURANCE LTD

- AETNA INSURANCE (SINGAPORE) PTE LTD

- AIA SINGAPORE PRIVATE LIMITED

- ALLIANZ GLOBAL CORPORATE & SPECIALTY AG, SINGAPORE BRANCH

- ALLIANZ INSURANCE COMPANY OF SINGAPORE PTE LTD

- AMERICAN INTERNATIONAL ASSURANCE COMPANY, LIMITED

- AVIVA LTD

- AXA LIFE INSURANCE SINGAPORE PRIVATE LIMITED

- CHARTIS SINGAPORE INSURANCE PTE. LTD.

- CHINA TAIPING INSURANCE (SINGAPORE) PTE. LTD.

- CIGNA EUROPE INSURANCE CO S.A.‐N.V., SPORE BRANCH

- COSMIC INSURANCE CORPORATION LTD

- DIRECT ASIA INSURANCE (SINGAPORE) PTE LTD

- ECICS LIMITED

- EQ INSURANCE COMPANY LTD

- ETIQA INSURANCE BERHAD

- FEDERAL INSURANCE COMPANY

- FIRST CAPITAL INSURANCE LTD

- FRIENDS PROVIDENT INTERNATIONAL LTD (SPORE BRANCH)

- GENERALI INTERNATIONAL LIMITED, SINGAPORE BRANCH

- HDI-GERLING INDUSTRIE VERSICHERUNG AG, S’PORE BRANCH

- HSBC INSURANCE (SINGAPORE) PTE. LIMITED

- INDIA INTERNATIONAL INSURANCE PTE LTD

- INTERGLOBAL INSURANCE COMPANY LIMITED, SG BRANCH

- INTERNATIONAL MEDICAL INSURERS PTE LTD

- LIBERTY INSURANCE PTE LTD

- LIBERTY MUTUAL INSURANCE EUROPE LIMITED

- LONPAC INSURANCE BERHAD

- MANULIFE (SINGAPORE) PTE. LTD.

- MSIG INSURANCE (SINGAPORE) PTE LTD

- NIPPONKOA INSURANCE COMPANY LIMITED

- NTUC INCOME INSURANCE CO-OPERATIVE LIMITED

- PRUDENTIAL ASSURANCE CO. SINGAPORE (PTE) LTD

- QBE INSURANCE INTERNATIONAL LTD

- ROYAL & SUN ALLIANCE INSURANCE PLC, S’PORE BRANCH

- ROYAL SKANDIA LIFE ASSURANCE LTD, S’PORE BRANCH

- SHC CAPITAL LIMITED

- SHENTON INSURANCE PTE LTD

- SINGAPORE AVIATION & GENERAL INSURANCE CO PTE LTD

- SOMPO JAPAN INSURANCE (SINGAPORE) PTE. LTD.

- STARR INTERNATIONAL INSURANCE (S’PORE) PTE LTD

- SWISS LIFE (SINGAPORE) PTE. LTD.

- TENET INSURANCE COMPANY LIMITED

- THE GREAT EASTERN LIFE ASSURANCE COMPANY LIMITED

- THE OVERSEAS ASSURANCE CORPORATION LIMITED

- TOKIO MARINE INSURANCE SINGAPORE LTD

- TOKIO MARINE LIFE INSURANCE SINGAPORE LTD

- TRANSAMERICA LIFE (BERMUDA) LTD.

- UNITED OVERSEAS INSURANCE LTD

- XL INSURANCE COMPANY LIMITED SINGAPORE BRANCH

- ZURICH INSURANCE COMPANY LTD (SINGAPORE BRANCH)

- ZURICH INTERNATIONAL LIFE LIMITED (S’PORE BRANCH)

- ZURICH LIFE INSURANCE (SINGAPORE) PTE LTD

- Individual term policies

- Individual whole life policies

- Individual endowment policies

- Individual annuities

- Individual short-term or long-term accident & health (A&H) policies (e.g. Hospital cash, Medical Expense, Personal Accident, Disability Income, Long-term Care)

- Group term policies

- Group whole life policies

- Group endowment policies

- Group annuities

- Group short-term and long-term accident & health (A&H) policies

- Personal motor insurance policies

- Personal travel insurance policies

- Personal property (structure and contents) insurance policies

- Foreign domestic maid insurance policies

- Individual and group short- term A&H policies

Depending on the type of your life insurance, the guarantee ranges from S$50,00 to S$500,000. There is no cap on the Accident and Health policies (less riders). For more details, see https://www.sdic.org.sg/pp_calc_of_comp.php

Where does SDIC get the money to pay you?

Likewise, SDIC collects levies members based on the size of their protected liabilities. SDIC invests in safe and liquid assets like Singapore Government Bonds.

I see this is a good approach to protect the minorities’ interests. This would also boost the confidence in our savings and insurance industry. To be sure, you should do a check on the proportion of your deposits and insurance policies that would qualify under these schemes.

CPF caps wrap fee for CPF Investment Scheme

From 1 July 2012, the CPF Board will subject the wrap fee charged for

CPF Investment Scheme (CPFIS) investments to a maximum limit of 1% per

annum.

The cap on wrap fees is intended to help members lower the costs of investing their CPF savings over the longer term. The move is another measure taken by the CPF Board as part of its efforts to progressively lower the costs of investment and improve the quality of products offered under the CPFIS since 2006. Past measures include the tightening of admission criteria for new funds and the setting of fee caps on sales charges and fund expense ratios

A wrap fee is a regular charge paid to financial advisers for providing bundled investment services, such as advisory, brokerage and administrative services. Also known as an ongoing fee, the wrap fee is typically levied monthly or quarterly by liquidating a small portion of the investment. Currently, CPF members who maintain wrap accounts for their CPFIS unit trust investments are charged a wrap fee of up to 1.5% per annum by their financial advisers.

The CPF Board urges members who wish to invest their CPF savings for potentially higher returns to do so prudently and to scrutinise the total cost of investment as high costs may potentially erode investment returns significantly over the long term.

Since 2006, the CPF Board has been undertaking measures to progressively lower the cost of investment and improve the quality of funds under the CPF Investment Scheme. The summary of the measures taken are as follows.

More information can be found from CPF Website.

The cap on wrap fees is intended to help members lower the costs of investing their CPF savings over the longer term. The move is another measure taken by the CPF Board as part of its efforts to progressively lower the costs of investment and improve the quality of products offered under the CPFIS since 2006. Past measures include the tightening of admission criteria for new funds and the setting of fee caps on sales charges and fund expense ratios

A wrap fee is a regular charge paid to financial advisers for providing bundled investment services, such as advisory, brokerage and administrative services. Also known as an ongoing fee, the wrap fee is typically levied monthly or quarterly by liquidating a small portion of the investment. Currently, CPF members who maintain wrap accounts for their CPFIS unit trust investments are charged a wrap fee of up to 1.5% per annum by their financial advisers.

The CPF Board urges members who wish to invest their CPF savings for potentially higher returns to do so prudently and to scrutinise the total cost of investment as high costs may potentially erode investment returns significantly over the long term.

Since 2006, the CPF Board has been undertaking measures to progressively lower the cost of investment and improve the quality of funds under the CPF Investment Scheme. The summary of the measures taken are as follows.

| From | Description | ||||||||||

| 1 Feb 2006 | Tightening of admission criteria. New funds must: (i) meet the revised benchmark set at the top 25 percentile of funds in the global peer group; (ii) have expense ratio that is lower than the median of existing CPFIS funds in its risk category; and (iii) preferably have track record of good performance for at least 3 years. |

||||||||||

| 1 Jul 2007 | Sales charge for CPFIS-included funds must not exceed 3%. | ||||||||||

| 1 Jan 2008 | Expense ratios for CPFIS-included funds must not exceed the median of existing CPF funds in its risk category:

|

||||||||||

| 1 Jan 2011 | All existing funds must meet the stricter admission criteria before accepting new CPF monies. |

Ferrari driver complained of lack of roads here for high-speed driving

SINGAPORE - Mr Ma Chi, 31, who passed away after his red Ferrari crashed

into a taxi while he was speeding to beat the red light, reportedly

told an ex-colleague that he had no intention to stay in Singapore

long-term as there was no place to drive his supercar at high speeds.

"The Lion City's too small, with no roads for driving at high speed," he told former colleague Zhong Yi in 2009.

According to The Beijing News, friends had mentioned that Mr Ma liked to drive in the middle of the night because there were less cars on the road.

The Straits Times reported that he owns another luxury sports car - an Infiniti, which costs at least 400,000 yuan (S$79,600). He keeps the car in his native province of Sichuan.

According to the English daily, Mr Ma first came to Singapore four years ago with his wife and child in 2008.

Friends said he was a hard-working and righteous person who worked as a financial investor. He was also applying for permanent residency in Singapore.

He died at the scene on May 4 while cabby Cheng Teck Hock and passenger Shigemi Ito died in hospital.

Mr Zhong said he himself had been in a car accident back in 2003, when he had been driving too fast and suffered a concussion from the accident.

He told Beijing News that he regretted not telling Mr Ma about, and sharing lessons learnt from the unfortunate experience.

"The Lion City's too small, with no roads for driving at high speed," he told former colleague Zhong Yi in 2009.

According to The Beijing News, friends had mentioned that Mr Ma liked to drive in the middle of the night because there were less cars on the road.

The Straits Times reported that he owns another luxury sports car - an Infiniti, which costs at least 400,000 yuan (S$79,600). He keeps the car in his native province of Sichuan.

According to the English daily, Mr Ma first came to Singapore four years ago with his wife and child in 2008.

Friends said he was a hard-working and righteous person who worked as a financial investor. He was also applying for permanent residency in Singapore.

He died at the scene on May 4 while cabby Cheng Teck Hock and passenger Shigemi Ito died in hospital.

Mr Zhong said he himself had been in a car accident back in 2003, when he had been driving too fast and suffered a concussion from the accident.

He told Beijing News that he regretted not telling Mr Ma about, and sharing lessons learnt from the unfortunate experience.

Heavy rains topple trees and smash cars

SINGAPORE - A heavy thunderstorm last night toppled trees and flooded roads all over Singapore.

According to an AsiaOne reader, the wind was so strong that the roads were littered with dangerous debris such as branches and the rain was coming down at an angle.

Stomp contributor Stanley wrote in to say that his car was next to an unfortunate cab that got dented by a falling tree.

"When I woke up this morning, I was shocked to see the back of the taxi was seriously damaged," he said, adding that the tree had been removed by the time he noticed the destruction.

He said the back screen of the taxi was shattered, but nobody was injured.

"I count myself fortunate as my car was just next to the taxi," he said.

Toppled trees were also spotted at Clementi and Hillview Road, where the tree at Clementi Avenue 2 fell on a parked car.

Stomp contributor Christinee who spotted the fallen tree at Hillview Road expressed surprise that such a "heavy big tree can actually fall so easily just because of the wind."

"It's lucky that no accidents were caused or anyone injured," she said.

The brief but heavy half-hour downpour also caused flood water to pool at the junction of Admiralty Road and Marsiling Drive early this morning.

According to an eye-witness, the water was at almost knee-level.

At about 6am this morning, the National Environmental Agency issued a warning of heavy rain ahead.

According to an AsiaOne reader, the wind was so strong that the roads were littered with dangerous debris such as branches and the rain was coming down at an angle.

Stomp contributor Stanley wrote in to say that his car was next to an unfortunate cab that got dented by a falling tree.

"When I woke up this morning, I was shocked to see the back of the taxi was seriously damaged," he said, adding that the tree had been removed by the time he noticed the destruction.

He said the back screen of the taxi was shattered, but nobody was injured.

"I count myself fortunate as my car was just next to the taxi," he said.

Toppled trees were also spotted at Clementi and Hillview Road, where the tree at Clementi Avenue 2 fell on a parked car.

Stomp contributor Christinee who spotted the fallen tree at Hillview Road expressed surprise that such a "heavy big tree can actually fall so easily just because of the wind."

"It's lucky that no accidents were caused or anyone injured," she said.

The brief but heavy half-hour downpour also caused flood water to pool at the junction of Admiralty Road and Marsiling Drive early this morning.

According to an eye-witness, the water was at almost knee-level.

At about 6am this morning, the National Environmental Agency issued a warning of heavy rain ahead.

New crash sparks calls for action on junction

In the wake of yet another collision at the junction of Rochor Road

and Victoria Street last Saturday morning, this time involving a Lexus

and a taxi, transport bodies and motorists are calling for the

authorities to step in to ensure that the junction is safe.

Members of the Government Parliamentary Committee for Transport whom my paper spoke to yesterday urged the Land Transport Authority (LTA) to look into the matter.

Mr Ang Hin Kee, a committee member and adviser to the National Taxi Association, said: "Following these accidents, the LTA should ensure that there are adequate safety measures in place, and that the road conditions and set-up are safe for all users."

Last Saturday's accident comes two weeks after a Ferrari allegedly beat the red light on the morning of May 12 and crashed into a taxi, resulting in three deaths.

The Lexus in the latest case - the eighth reported at the junction in the past month - also allegedly beat a red light and hit the tail end of the taxi, causing the cab to spin.

The driver of the Lexus, a 30-year-old Singaporean man, was arrested for suspected drink driving and dangerous driving.

Mr Ang also suggested that the authorities should consider getting taxi companies to make taxis safer by installing airbags and conducting routine mainte- nance checks on cabs.

"A safer road for taxis is also a safer road for other motorists, and will be beneficial for all."

On whether taxi drivers needed more training in road safety, he said that was not necessary as there were no mistakes made by the cabbies in both the latest accident and the Ferrari crash, where their driving skills were concerned.

He supported calls for a separate licensing and competency test for drivers of "supercars", as "the capacity and performance (of a supercar) are very different from those of a normal sedan, and drivers may not know how to handle that kind of horse- power".

Fellow committee member Gan Thiam Poh said it was the responsibility of motorists to help prevent accidents and that safety should be a priority.

Mr Gerard Ee, chairman of the Public Transport Council, said that the roads at the junction are wide and, coupled with the lighter traffic conditions in the wee hours, drivers may be more likely to speed.

"The focus of the accidents should not be on the cars, but on the recklessness of the drivers.

Motorists should comply with traffic regulations to prevent accidents from happening," he reiterated.

Other motorists also urged for more to be done.

Undergraduate Marcus Tan, 24, said: "The LTA should identify any blind spots that make the junction prone to accidents, and correct them as soon as possible, before another fatality happens."

A netizen said on citizen-journalism website Stomp yesterday that there appeared to be a surveillance camera with a "perfect vantage point" installed at the junction, and suggested that the authorities use the footage captured to further probe the accidents.

Members of the Government Parliamentary Committee for Transport whom my paper spoke to yesterday urged the Land Transport Authority (LTA) to look into the matter.

Mr Ang Hin Kee, a committee member and adviser to the National Taxi Association, said: "Following these accidents, the LTA should ensure that there are adequate safety measures in place, and that the road conditions and set-up are safe for all users."

Last Saturday's accident comes two weeks after a Ferrari allegedly beat the red light on the morning of May 12 and crashed into a taxi, resulting in three deaths.

The Lexus in the latest case - the eighth reported at the junction in the past month - also allegedly beat a red light and hit the tail end of the taxi, causing the cab to spin.

The driver of the Lexus, a 30-year-old Singaporean man, was arrested for suspected drink driving and dangerous driving.

Mr Ang also suggested that the authorities should consider getting taxi companies to make taxis safer by installing airbags and conducting routine mainte- nance checks on cabs.

"A safer road for taxis is also a safer road for other motorists, and will be beneficial for all."

On whether taxi drivers needed more training in road safety, he said that was not necessary as there were no mistakes made by the cabbies in both the latest accident and the Ferrari crash, where their driving skills were concerned.

He supported calls for a separate licensing and competency test for drivers of "supercars", as "the capacity and performance (of a supercar) are very different from those of a normal sedan, and drivers may not know how to handle that kind of horse- power".

Fellow committee member Gan Thiam Poh said it was the responsibility of motorists to help prevent accidents and that safety should be a priority.

Mr Gerard Ee, chairman of the Public Transport Council, said that the roads at the junction are wide and, coupled with the lighter traffic conditions in the wee hours, drivers may be more likely to speed.

"The focus of the accidents should not be on the cars, but on the recklessness of the drivers.

Motorists should comply with traffic regulations to prevent accidents from happening," he reiterated.

Other motorists also urged for more to be done.

Undergraduate Marcus Tan, 24, said: "The LTA should identify any blind spots that make the junction prone to accidents, and correct them as soon as possible, before another fatality happens."

A netizen said on citizen-journalism website Stomp yesterday that there appeared to be a surveillance camera with a "perfect vantage point" installed at the junction, and suggested that the authorities use the footage captured to further probe the accidents.

Saturday, May 26, 2012

5 tips to being forever young

A healthy ageing system encompasses the entire body system so that a person can age well from the inside out.

We are entering an unprecedented era worldwide, where many countries, have increasing numbers of their population reaching old age and fewer babies being born.

We are all going to live longer, there is no doubt about it.

But wouldn't you like to reach old age without actually looking

or feeling your age? Wouldn't it be great if you could still perform at

your peak, be in good shape and enjoy great health?

The ageing process affects your entire body, from every cell within to your outward appearance.

However, the ageing process can be slowed down or tempered so that we can still enjoy our later years.

It is not just about fighting wrinkles and grey hair, but also about maintaining our organ functions, staying mentally active and physically strong.

The right way to address ageing is not with piecemeal methods - an injection here, a supplement there - but to approach the entire body system, so that you can age well from the inside out.

Starting with nutrition

Nutrition is really the key to longevity - we know that populations have been able to live longer because we have access to better food today than we used to.

But good nutrition also helps us to live well - food does not only provide calories for energy, but also a variety of micronutrients, macronutrients and healthful components that work in unique ways to keep our cells, tissues, nerves, muscles and organs healthy.

The reason people age drastically, fall prey to long-term diseases, get brittle bones and become weak is because nutrition has failed them - or rather, they have failed themselves by eating an unhealthy and inappropriate diet.

A balanced diet, with the right proportion of nutrients from a variety of foods, is only the first step.

Be sure you do not overeat foods that are high in fat and sugar. The bulk of your carbohydrates should come from whole-grain sources, not simple, processed carbohydrates.

Eat plenty of foods that are rich in fibre, namely fruits, vegetables and the whole-grain foods that I mentioned earlier.

Very few people actually eat enough fruits and vegetables every day, so you will be amazed at the difference it will make in your life.

Cut out foods containing pesticides, antibiotics and hormones from your diet. Eat more fresh and natural foods, rather than processed or instant food that comes in a package!

If you are not getting sufficient vitamins and minerals from your diet, you may need nutrient supplements to fill in the gaps.

Finally, drink enough water every day so that your body can flush out toxins from the system and your cells can stay healthy and nourished.

Restful qualities of sleep

I cannot over-emphasise the importance of sleep in helping you to stay well into your older years.

If the body and mind do not have the opportunity to rest and restore itself, your cells will be more vulnerable to damage, and this will eventually lead to a breakdown in the system.

Get at least seven hours of sleep each night. Make sure that you sleep in a comfortable environment to get a restful night's sleep, not one that is disturbed by light and noise.

Exercise to stay young

Some people may be more enthusiastic about exercise if they believe that it can help them to stay young.

While exercise may not have unlocked the secret to immortality, it certainly plays a big role in delaying the effects of ageing.

A regular exercise regime - and being physically active in other ways - from a younger age will help your body to build up reserves so that you do not succumb easily to old age problems like falls and frailty.

Make sure you incorporate three different types of exercise into your "anti-ageing" exercise regime.

The first is to stretch all the big and small muscle groups in your body, so that they remain flexible and help carry your body well. When our muscles are tight, they easily become injured when we lift heavy objects or make a certain movement.

Strength-training exercises, which include lunges, squats, partial sit-ups, push-ups and training with weights, are also very important.

These exercises help you to maintain lean muscle and bone density, not only avoiding the saggy bits that women are so afraid of, but also ensuring better balance.

Finally, you also need cardiovascular exercise to keep your lungs and heart healthy. Every day, accumulate at least 30 minutes of moderately intense physical activities that get your heart pumping and your body sweating.

You can take a brisk walk around the neighbourhood, go cycling, swimming or dancing, or play a sport like badminton, tennis or football.

Hormone balance

Your hormones are another crucial piece of the ageing-well puzzle.

Hormonal imbalance is the underlying cause of many diseases and ageing problems, although it is not well recognised.

Many factors in our lives - including the food we eat, the stress we go through and the environment around us - cause our hormones to become imbalanced.

There is better recognition now of the role that hormones play in our overall health.

If you are suffering from problems caused by a disruption in your hormonal milieu, you may want to consider working with an anti-ageing doctor or a compounding pharmacist to optimise your hormonal profile so that you can have better immune health to prevent disease and infections.

Looking at your hormone profile involves minimising the impact of hormones such as cortisol, insulin, and environmental oestrogens, which are the main culprits that cause you to lose muscle, gain fat, and become depressed as age increases.

Then, you can also have bioidentical hormone therapy prescribed to adjust and restore your hormonal balance such as DHEA, cortisol, oestrogen, progesterone, testosterone, thyroid, melatonin, pregnenolone or growth hormone.

Health screening

The final approach in the healthy ageing system is regular health screening.

These are simple tests that you should do (following a schedule) to keep tabs on various aspects of your health.

Many of these tests should already be part of your regular screening programme, such as blood chemistry, blood glucose, cancer markers, inflammatory markers (eg homocysteine) and hormone levels.

You can do these tests when you go for your annual medical check-ups (which should be part of your personal healthcare routine).

Some simple screening tests can be done at home so that you can quickly identify if something needs attention immediately.

Tests for blood pressure, blood glucose and cholesterol can be done with home test kits.

If you have hypertension, diabetes or heart disease, you must measure these levels at home according to your doctor's advice.

This allows you to immediately recognise a problem if your levels suddenly increase or decrease.

You should also weigh yourself at least once a week, otherwise you might find your weight insidiously increasing and putting you at risk of many diseases that are common in older age, such as diabetes and heart disease.

With more advanced research being carried out, there may be even more accurate and personalised health tests available to us in the future.

Genomic and DNA testing, metabolic-typing and blood-typing may provide valuable insights into a person's unique biochemistry and DNA genetics, allowing a holistic health and diet programme to be customised.

You don't have to wait until you hit old age to start practising a healthy ageing lifestyle.

If you want to stay youthful, you have to start taking care of your health when you are young!

We are entering an unprecedented era worldwide, where many countries, have increasing numbers of their population reaching old age and fewer babies being born.

We are all going to live longer, there is no doubt about it.

The ageing process affects your entire body, from every cell within to your outward appearance.

However, the ageing process can be slowed down or tempered so that we can still enjoy our later years.

It is not just about fighting wrinkles and grey hair, but also about maintaining our organ functions, staying mentally active and physically strong.

The right way to address ageing is not with piecemeal methods - an injection here, a supplement there - but to approach the entire body system, so that you can age well from the inside out.

Starting with nutrition

Nutrition is really the key to longevity - we know that populations have been able to live longer because we have access to better food today than we used to.

But good nutrition also helps us to live well - food does not only provide calories for energy, but also a variety of micronutrients, macronutrients and healthful components that work in unique ways to keep our cells, tissues, nerves, muscles and organs healthy.

The reason people age drastically, fall prey to long-term diseases, get brittle bones and become weak is because nutrition has failed them - or rather, they have failed themselves by eating an unhealthy and inappropriate diet.

A balanced diet, with the right proportion of nutrients from a variety of foods, is only the first step.

Be sure you do not overeat foods that are high in fat and sugar. The bulk of your carbohydrates should come from whole-grain sources, not simple, processed carbohydrates.

Eat plenty of foods that are rich in fibre, namely fruits, vegetables and the whole-grain foods that I mentioned earlier.

Very few people actually eat enough fruits and vegetables every day, so you will be amazed at the difference it will make in your life.

Cut out foods containing pesticides, antibiotics and hormones from your diet. Eat more fresh and natural foods, rather than processed or instant food that comes in a package!

If you are not getting sufficient vitamins and minerals from your diet, you may need nutrient supplements to fill in the gaps.

Finally, drink enough water every day so that your body can flush out toxins from the system and your cells can stay healthy and nourished.

Restful qualities of sleep

I cannot over-emphasise the importance of sleep in helping you to stay well into your older years.

If the body and mind do not have the opportunity to rest and restore itself, your cells will be more vulnerable to damage, and this will eventually lead to a breakdown in the system.

Get at least seven hours of sleep each night. Make sure that you sleep in a comfortable environment to get a restful night's sleep, not one that is disturbed by light and noise.

Exercise to stay young

Some people may be more enthusiastic about exercise if they believe that it can help them to stay young.

While exercise may not have unlocked the secret to immortality, it certainly plays a big role in delaying the effects of ageing.

A regular exercise regime - and being physically active in other ways - from a younger age will help your body to build up reserves so that you do not succumb easily to old age problems like falls and frailty.

Make sure you incorporate three different types of exercise into your "anti-ageing" exercise regime.

The first is to stretch all the big and small muscle groups in your body, so that they remain flexible and help carry your body well. When our muscles are tight, they easily become injured when we lift heavy objects or make a certain movement.

Strength-training exercises, which include lunges, squats, partial sit-ups, push-ups and training with weights, are also very important.

These exercises help you to maintain lean muscle and bone density, not only avoiding the saggy bits that women are so afraid of, but also ensuring better balance.

Finally, you also need cardiovascular exercise to keep your lungs and heart healthy. Every day, accumulate at least 30 minutes of moderately intense physical activities that get your heart pumping and your body sweating.

You can take a brisk walk around the neighbourhood, go cycling, swimming or dancing, or play a sport like badminton, tennis or football.

Hormone balance

Your hormones are another crucial piece of the ageing-well puzzle.

Many factors in our lives - including the food we eat, the stress we go through and the environment around us - cause our hormones to become imbalanced.

There is better recognition now of the role that hormones play in our overall health.

If you are suffering from problems caused by a disruption in your hormonal milieu, you may want to consider working with an anti-ageing doctor or a compounding pharmacist to optimise your hormonal profile so that you can have better immune health to prevent disease and infections.

Looking at your hormone profile involves minimising the impact of hormones such as cortisol, insulin, and environmental oestrogens, which are the main culprits that cause you to lose muscle, gain fat, and become depressed as age increases.

Then, you can also have bioidentical hormone therapy prescribed to adjust and restore your hormonal balance such as DHEA, cortisol, oestrogen, progesterone, testosterone, thyroid, melatonin, pregnenolone or growth hormone.

Health screening

The final approach in the healthy ageing system is regular health screening.

Many of these tests should already be part of your regular screening programme, such as blood chemistry, blood glucose, cancer markers, inflammatory markers (eg homocysteine) and hormone levels.

You can do these tests when you go for your annual medical check-ups (which should be part of your personal healthcare routine).

Some simple screening tests can be done at home so that you can quickly identify if something needs attention immediately.

Tests for blood pressure, blood glucose and cholesterol can be done with home test kits.

If you have hypertension, diabetes or heart disease, you must measure these levels at home according to your doctor's advice.

This allows you to immediately recognise a problem if your levels suddenly increase or decrease.

You should also weigh yourself at least once a week, otherwise you might find your weight insidiously increasing and putting you at risk of many diseases that are common in older age, such as diabetes and heart disease.

With more advanced research being carried out, there may be even more accurate and personalised health tests available to us in the future.

Genomic and DNA testing, metabolic-typing and blood-typing may provide valuable insights into a person's unique biochemistry and DNA genetics, allowing a holistic health and diet programme to be customised.

You don't have to wait until you hit old age to start practising a healthy ageing lifestyle.

If you want to stay youthful, you have to start taking care of your health when you are young!

Drink driver arrested for another accident at Ferrari crash site

SINGAPORE - The site of the horrific Ferrari crash two weeks ago was again the scene of another accident early Saturday morning.

A Lexus and a Comfort taxi were involved in a traffic accident at the junction of Rochor Road and Victoria Street, local media reports said.

One of the victims - the male taxi passenger - was sent to the Singapore General Hospital after the accident, which was reported to the police at about 3.15am this morning. He received outpatient treatment.

According to a latest statement by the police, a 30-year-old driver of the Lexus has been arrested on suspicion of drink driving and dangerous driving.

A breathalyser test result showed 42 microgrammes of alcohol per 100 millilitres of breath, exceeding the prescribed legal limit of 35 microgrammes of alcohol per 100 millilitres. If convicted, he will be disqualified from driving for at least 12 months.

Those found guilty of drink driving will also lose their driving licences and have to retake the theory and practical driving tests in order to obtain their driving licences again.

In addition, first-time offenders can be fined between $1,000 and $5,000, or jailed up to 6 months.

Repeat offenders may be punished with a maximum fine of $30,000 and a mandatory jail term of up to three years. They may also be caned up to six strokes should death or serious injury be caused.

A Lexus and a Comfort taxi were involved in a traffic accident at the junction of Rochor Road and Victoria Street, local media reports said.

One of the victims - the male taxi passenger - was sent to the Singapore General Hospital after the accident, which was reported to the police at about 3.15am this morning. He received outpatient treatment.

According to a latest statement by the police, a 30-year-old driver of the Lexus has been arrested on suspicion of drink driving and dangerous driving.

A breathalyser test result showed 42 microgrammes of alcohol per 100 millilitres of breath, exceeding the prescribed legal limit of 35 microgrammes of alcohol per 100 millilitres. If convicted, he will be disqualified from driving for at least 12 months.

Those found guilty of drink driving will also lose their driving licences and have to retake the theory and practical driving tests in order to obtain their driving licences again.

In addition, first-time offenders can be fined between $1,000 and $5,000, or jailed up to 6 months.

Repeat offenders may be punished with a maximum fine of $30,000 and a mandatory jail term of up to three years. They may also be caned up to six strokes should death or serious injury be caused.

Wednesday, May 23, 2012

Part-time student, 26, dies suddenly in his sleep

SINGAPORE - His last words to his parents were "I'm very tired",

before going into his room to take a nap. But his parents never saw

26-year-old Tan Songchun alive again.

Tan, a part-time student at the Singapore Institute of Management, was found lying motionless on his bed at about 11pm yesterday.

"His mouth was slightly open and his face was serene, like he was sleeping," said his father.

His mother, who discovered his body, told reporters from Shin Min News Daily that she also found a pool of vomit beside him on his bed.

According to the Chinese evening daily, Tan had come home at about 7pm, after work.

Complaining that he was tired, he told his parents that he would take a nap before dinner. But when he did not emerge from his room a few hours later, his mother went to check on him and found his lifeless body.

Paramedics believe he had been dead for at least an hour.

His father, a 55-year-old odd-job worker, said his son had always been healthy and was filial. The younger Tan had wanted to earn a degree so he could get a better paying job to help support the family.

He had just taken a week's leave to study for his exams, and yesterday was the first day he went back to work.

A doctor interviewed by Shin Min said that vomitting could be caused by a number of reasons including heart and digestive problems, or a head injury.

Vomitting could lead to death if it got into the lungs, leading to pneumonia. But this was more prevalent in alcoholics and the elderly.

He said it was unlikely that vomitting itself could be the cause of death here.

Tan, a part-time student at the Singapore Institute of Management, was found lying motionless on his bed at about 11pm yesterday.

"His mouth was slightly open and his face was serene, like he was sleeping," said his father.

His mother, who discovered his body, told reporters from Shin Min News Daily that she also found a pool of vomit beside him on his bed.

According to the Chinese evening daily, Tan had come home at about 7pm, after work.

Complaining that he was tired, he told his parents that he would take a nap before dinner. But when he did not emerge from his room a few hours later, his mother went to check on him and found his lifeless body.

Paramedics believe he had been dead for at least an hour.

His father, a 55-year-old odd-job worker, said his son had always been healthy and was filial. The younger Tan had wanted to earn a degree so he could get a better paying job to help support the family.

He had just taken a week's leave to study for his exams, and yesterday was the first day he went back to work.

A doctor interviewed by Shin Min said that vomitting could be caused by a number of reasons including heart and digestive problems, or a head injury.

Vomitting could lead to death if it got into the lungs, leading to pneumonia. But this was more prevalent in alcoholics and the elderly.

He said it was unlikely that vomitting itself could be the cause of death here.

Ferrari crash junction, red light rogues still beat light

The junction where the accident occurred is notorious for motorists running the red light.

Netizens have claimed that, as a result, there have been countless near misses at the junction of Victoria Street and Rochor Road.

Just two Saturdays ago, three people were killed after a Ferrari driver allegedly ignored a red light there before crashing into a taxi.

The Ferrari driver, Mr Ma Chi, 31, a Chinese national, died at the scene.

The taxi driver, Mr Cheng Teck Hock, 52, and his Japanese passenger, Ms Shigemi Ito, 41, died in hospital.

The situation is worse on Fridays and Saturdays, netizens said, as revellers leave watering holes at places like Boat Quay and Orchard Road and head down Victoria Street towards Kallang.

Two weeks after the accident, The New Paper waited at the same junction from 1am to 4am on Saturday. How bad was it?

Despite the accident, some motorists still blatantly beat the red lights at the junction.

Three cars, two taxis and a motorcycle ran the light when TNP was at the junction.

The first offender, a motorcyclist, was spotted at 1.30am.

He rode down Victoria Street and turned left into Rochor Road even though the light had turned red.

Traffic at the junction became less heavy soon after.

But between 3am and 4am, as clubbers left from a night of partying, the roads became crowded again with cars revving their engines.

Most of the vehicles were travelling from the city down Victoria Street towards Kallang.

A dark-coloured car beat the red light at 3am about five seconds after it changed from green.

About 15 minutes later, another car and a taxi were seen doing the same.

A light-coloured car, this time travelling from the East Coast Parkway down Rochor Road, beat the red light soon after at 3.25am.

About five minutes after this, another taxi travelling down Victoria Street was spotted doing likewise as it turned into Rochor Road.

No camera

The junction isn't fitted with a red-light camera.

The offence of jumping a red light carries a six- month jail term.

But first offenders are usually fined up to $1,000 and given 12 demerit points. Any motorist who accumulates 24 or more demerit points within two years will be barred from driving for a year.

Motorists whom TNP spoke to said that another accident at the junction is imminent if fellow road users continue beating the red light there.

One motorist, Mr Trevor Chan, 36, who works in the sales line, said: "Maybe it's time that the authorities install a red-light camera at the junction. Only then would motorists stop breaking the law there."

A primary school teacher, who declined to be named, felt the same way.

"This is the only way to stop these irresponsible motorists from breaking the law," she said.

Netizens have claimed that, as a result, there have been countless near misses at the junction of Victoria Street and Rochor Road.

Just two Saturdays ago, three people were killed after a Ferrari driver allegedly ignored a red light there before crashing into a taxi.

The Ferrari driver, Mr Ma Chi, 31, a Chinese national, died at the scene.

The taxi driver, Mr Cheng Teck Hock, 52, and his Japanese passenger, Ms Shigemi Ito, 41, died in hospital.

The situation is worse on Fridays and Saturdays, netizens said, as revellers leave watering holes at places like Boat Quay and Orchard Road and head down Victoria Street towards Kallang.

Two weeks after the accident, The New Paper waited at the same junction from 1am to 4am on Saturday. How bad was it?

Despite the accident, some motorists still blatantly beat the red lights at the junction.

Three cars, two taxis and a motorcycle ran the light when TNP was at the junction.

The first offender, a motorcyclist, was spotted at 1.30am.

He rode down Victoria Street and turned left into Rochor Road even though the light had turned red.

Traffic at the junction became less heavy soon after.

But between 3am and 4am, as clubbers left from a night of partying, the roads became crowded again with cars revving their engines.

Most of the vehicles were travelling from the city down Victoria Street towards Kallang.

A dark-coloured car beat the red light at 3am about five seconds after it changed from green.

About 15 minutes later, another car and a taxi were seen doing the same.

A light-coloured car, this time travelling from the East Coast Parkway down Rochor Road, beat the red light soon after at 3.25am.

About five minutes after this, another taxi travelling down Victoria Street was spotted doing likewise as it turned into Rochor Road.

No camera

The junction isn't fitted with a red-light camera.

The offence of jumping a red light carries a six- month jail term.

But first offenders are usually fined up to $1,000 and given 12 demerit points. Any motorist who accumulates 24 or more demerit points within two years will be barred from driving for a year.

Motorists whom TNP spoke to said that another accident at the junction is imminent if fellow road users continue beating the red light there.

One motorist, Mr Trevor Chan, 36, who works in the sales line, said: "Maybe it's time that the authorities install a red-light camera at the junction. Only then would motorists stop breaking the law there."

A primary school teacher, who declined to be named, felt the same way.

"This is the only way to stop these irresponsible motorists from breaking the law," she said.

10 countries with the highest tax rates

It's often been said that in life, nothing is certain but death and taxes.

For some countries, paying taxes is an even more conspicuous presence in people's lives, with tax rates of almost sixty per cent.

Taxes for Singaporeans and its residents are still fairly moderate, especially when compared to the other countries in the list, with no tax levied for the first $20,000 of a person's chargeable income, with the maximum cap rate charged at 20 per cent for the highest level of earners.

A survey conducted by accounting firm KPMG in 2011 ranks 96 countries in terms of the top marginal tax rate.

10. Ireland

Highest income tax rate: 48% Average income in 2010: US$50,400

9. Finland Highest income tax rate: 49.2% Average income in 2010: US$49,000

(Tied) 5. United Kingdom Highest income tax rate: 50% Average income in 2010: US$52,320

(Tied) 5. Japan Highest income tax rate: 50% Average income in 2010: US$53,200

(Tied) 5. Belgium Highest income tax rate: 50% Average income in 2010: US$52,700

(Tied) 5. Austria Highest income tax rate: 50% Average income in 2010: US$50,700

4. The Netherlands Highest income tax rate: 52% Average income in 2010: US$57,000

3. Denmark Highest income tax rate: 55.4% Average income in 2010: US$64,000

2. Sweden Highest income tax rate: 56.6% Average income in 2010: US$48,800

1. Aruba Highest income tax rate: 58.95% Average income in 2010: N/A

For some countries, paying taxes is an even more conspicuous presence in people's lives, with tax rates of almost sixty per cent.

Taxes for Singaporeans and its residents are still fairly moderate, especially when compared to the other countries in the list, with no tax levied for the first $20,000 of a person's chargeable income, with the maximum cap rate charged at 20 per cent for the highest level of earners.

10. Ireland

Highest income tax rate: 48% Average income in 2010: US$50,400

9. Finland Highest income tax rate: 49.2% Average income in 2010: US$49,000

(Tied) 5. United Kingdom Highest income tax rate: 50% Average income in 2010: US$52,320

(Tied) 5. Japan Highest income tax rate: 50% Average income in 2010: US$53,200

(Tied) 5. Belgium Highest income tax rate: 50% Average income in 2010: US$52,700

(Tied) 5. Austria Highest income tax rate: 50% Average income in 2010: US$50,700

4. The Netherlands Highest income tax rate: 52% Average income in 2010: US$57,000

3. Denmark Highest income tax rate: 55.4% Average income in 2010: US$64,000

2. Sweden Highest income tax rate: 56.6% Average income in 2010: US$48,800

1. Aruba Highest income tax rate: 58.95% Average income in 2010: N/A

COE prices fall across the board

SINGAPORE: Certificate of Entitlement (COE) prices fell across the board after the latest bidding exercise on Tuesday.

The biggest drop was in the big car category, where premiums fell S$6,834 to S$85,216.

The premiums for small cars also fell, down S$4,599 to close at S$58,001

The COE prices for the open category, which is mostly used for big cars, fell S$2,101 to end at S$86,889.

COEs for commercial vehicles also fell, going down S$1,447 to S$57,106.

Premiums for motorcycles also went down, dipping S$131 to S$1,890.

The biggest drop was in the big car category, where premiums fell S$6,834 to S$85,216.

The premiums for small cars also fell, down S$4,599 to close at S$58,001

The COE prices for the open category, which is mostly used for big cars, fell S$2,101 to end at S$86,889.

COEs for commercial vehicles also fell, going down S$1,447 to S$57,106.

Premiums for motorcycles also went down, dipping S$131 to S$1,890.

Marina Bay Cruise Centre Singapore to create some 3,000 jobs

SINGAPORE:

Singapore's second cruise terminal, the Marina Bay Cruise Centre

Singapore, is expected to generate some 3,000 jobs in the tourism sector

when it's fully operational.

The terminal is operated by SATS-Creuers Cruise Services. This addition and the Singapore Cruise Centre at HarbourFront are expected to grow the leisure cruise sector in Singapore.

Second Minister for Trade and Industry S Iswaran said that cruise passenger numbers are expected to hit 1.5 million in three to five years.

Passenger numbers reached close to one million last year.

Costing about S$500 million, the 28,000 square metres Marina Bay Cruise Centre can handle about 6,800 passengers at any one time.

The arrival and departure halls will comprise 80 check-in counters and up to 40 immigration counters. Also about six shops are expected to be set up which include food and beverage and convenience stores.

Other facilities include 25 coach bays, 327 carpark lots and convenient road access with provisions made for future walkway linkages to MRT stations, the waterfront promenade and the park.

The cruise centre at Marina South will double Singapore's berthing capacity and will cater to the world's largest cruise ships.

Despite the drop in cruise passenger numbers in the last two years, the Singapore Tourism Board (STB) is confident of a more buoyant outlook.

Ms Aw Kah Peng, chief executive of the STB, said: "Our numbers in terms of throughput has fallen and it's partly because the industry here is restructuring. After the two IRs opened, many of the gaming ships didn't make sense anymore. So for them, it made sense for them not to continue.

"But I think the structural adjustment is almost at the tail end. Now we are seeing more interest from cruise ships that are not gaming ships."

She also added that more cruise liners are showing interest in Asia mainly because the market is doing well here. For example, Asia accounts for close to 20 per cent of the global outbound travel.

The terminal is also expected to have spillover benefits in the economy.

Second Minister for Trade and Industry and Home Affairs and Minister in the Prime Minister's Office, S Iswaran, said: "All the supporting services for the cruise ships and also the onshore tourism services will be big factors. The hotels also stand to benefit to the extent that we become a turnaround cruise spot. People come to Singapore in order to board their cruise ship or to disembark in Singapore before going home which means the fly cruise component is quite important and for that we're also quite well positioned because of our air connectivity."

The cruise-fly packages is aimed at making it more seamless for passengers to connect to the airport and will be made available from May 26, facilitated by the terminal's access to the airport. Currently it will only service Silkair, Singapore Airlines and Qantas passengers.

The Royal Caribbean's Voyager of the Seas will be the largest ship to make its way here on 26 May, paving the way for larger cruise liners to dock in Singapore and Asia.

The ship has a capacity of 3,840 passengers and 1,176 crew.

Currently, the terminal is only open to cruise liners, passengers and authorised personnel and will only open its doors to the public in the second half of this year.

SATS-Creuers Cruise Services which operates the terminal said that one of the challenges when constructing the facility was to tackle the low tides. As such, cages were built to aid the crew to load or unload baggage more effectively.